Slowly, slowly, Huawei is piecing together its alternatives to Google’s software and services, bedding down for a world where there can be no post-blacklist return to business as usual. And while the mood music from Shenzhen still suggests that the company would like nothing more than restoring Google on its new phones, the truth is much more complicated. The strategy in Shenzhen goes beyond phones, leveraging China’s huge investments in 5G and AI, looking at areas in which it can establish its brand beyond 5G network kit and consumer devices.

At around the time of the Mate 30 launch last fall, Huawei also started talking up its new connected car platform—HiCar. And while this may have come across as an Android Auto (or Apple CarPlay) lookalike, compensating for the company’s loss of Google, that isn’t the plan. This is much more radical, a fundamentally different approach to the one taken by Google and Apple. Pitched at automakers as well as the drivers of their cars, this is API-level integration to car functions, linkages to cameras, fatigue and safety checks, even cloud-based services. All that atop the usual infotainment and navigation options.

Now the rubber is about to hit the road on HiCar, quite literally, as Huawei looks to shepherd the tech onto countless cars from dozens of manufacturers. This is the year that HiCar becomes a reality and we will find out whether it is a viable option in itself, and how it battles Google (and Apple) apps in the auto space. If Huawei gets the strategy right, it will help fill some of the international smartphone-shaped gap in its revenues, while millions of its users will stand to benefit.

In the aftermath of the launch of the P40, its latest non-Google flagship, Huawei has been lauding the features of HiCar and its coming to market this year. The company has reportedly ensured that HiCar will reach its users en masse in 2020, shipping on as many as 120 different car models from 30 manufacturers.

In the six months since the HiCar chatter began, we’ve seen Chinese automaker (and GM joint venture) Baojun become the first to launch a vehicle with the tech onboard. The company says all future vehicles will get the update. The expectation is that many other manufacturers will follow this year—not just in China but overseas as well; according to Nikkei Asian Review and ChinaPEV, German giant Audi is among them. Audi has been approached for any comments on this.

As I reported yesterday, May 8, Huawei is quietly using its balance sheet to fund investments in connected automotive technologies. Bringing together consumer OS expertise with advancements in silicon and cloud services, the Chinese giant has set itself the goal of becoming the “leading Chinese platform provider” in the space.

Huawei’s newest business unit is Intelligent Automotive Solution (IAS), and it could become one of its most important. Automotive is at the very intersection of huge investments in AI, 5G, cloud and IoT. That’s why Huawei’s competition in the space includes Apple, Google’s stablemate Waymo and Tesla. China is the world’s largest car market and will likely lead the world for next-gen autonomous vehicles as well. Huawei is well placed—right place, right time.

Huawei doesn’t want to make cars—it wants to bolt an intelligent computing and communications platform to the auto-motive platforms built by others—it sees this as a full 70% of the value. That’s for the future—for millions of users today, though, the company has ambitious plans that also centre on your driving experience.

We’ve seen how critical navigation is to the modern-day smartphone experience. One of the critical factors in blacklisted Huawei’s loss of Google was the need to replace Google Maps. This isn’t just the app, it’s the navigation services stitched into the operating system, able to drive great swathes of the user experience.

Huawei countered this by securing Here mapping technologies for its phones—both surprising and clever, this is a genuinely competitive offering to Google. And this isn’t all—the company has also secured a partnership with MapmyIndia for the huge Indian market. It’s all part of the same theme—box out full-fat Android.

And so to HiCar, which needs to be viewed as part of Huawei’s broader auto strategy and not as an Android Auto fill-in. The tech is more a play to automakers than users, providing smartphone integration beyond infotainment—think aircon and even winding down the windows initially, but also pre-emptive maintenance and diagnostics, fleet management, even safety applications.

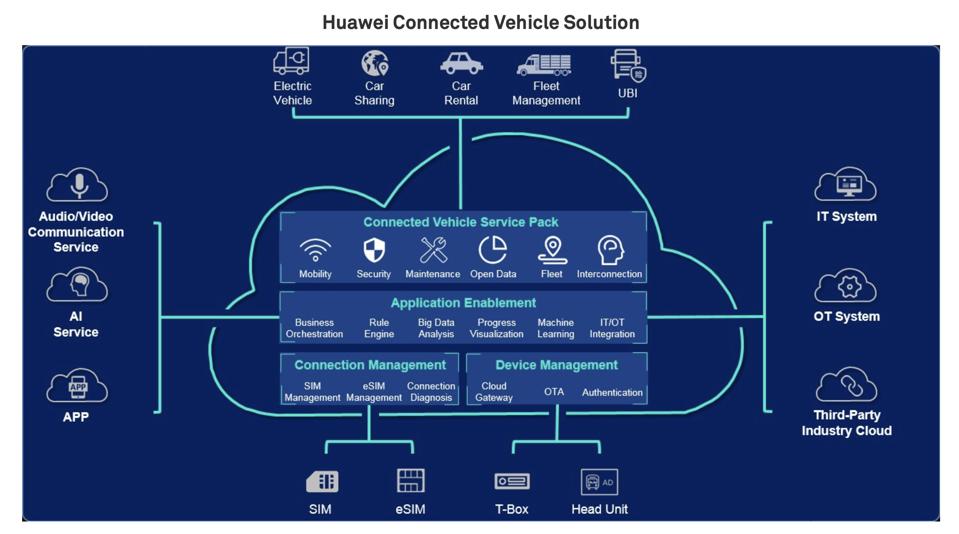

Huawei’s vision is to provide a cloud platform alongside “Internet of Vehicles” solutions to automakers and their customers. Using its scale and OS, the company can then enable those auto makers to digitize a wide range of services without having to take on the burden themselves. Clearly, this aligns with its strategy to be the ICT bolt-on for next-gen cars and not the car itself—unlike Apple (reportedly), Waymo and the likes of Tesla, as well as today’s mainstream automakers.

For traditional automakers and next-gen OEMs, Huawei is offering a clever pitch: No disintermediation threat as it has no ambition to build cars; no data ownership debate as there is with Google and Apple. Perhaps an automaker can have the tech savvy of a leading phone player without losing control—the core platform doesn’t even need the driver to be a Huawei user. “OK Google, whose customer am I now?”

Meanwhile, for millions of Huawei users, this fits the “Seamless AI Life” strategy to enable moving cross-platform, enabled by Huawei’s new OS and Mobile Services. That said, a week short of the first anniversary of Huawei’s U.S. blacklist, this becomes yet one more complexity in unpicking global supply chains.