Prudential Plc is boosting technology investment in Asia as part of its plans to double earnings in the region in coming years.

The U.K. insurer will raise annual spending by 20 percent to 300 million pounds ($427 million) from this year in areas such as automation and online sales and support to attract younger customers who are increasingly expecting instant service, said Nic Nicandrou, chief executive of its Asia operation.

“Technology initiatives including automation are one of the key drivers to achieving Prudential’s growth ambitions in Asia,” Nicandrou, 52, said in an interview, adding that he expects earnings in the region to double every five to seven years. Prudential posted 2.4 billion pounds of new business profit and 2 billion pounds of operating profit in Asia last year.

Britain’s largest insurer is benefiting from an expanding middle class and growing insurance coverage in Asia, where it gets about a third of its earnings. The company announced plans last month to spin off its U.K. operations, allowing it to focus on faster-growth markets in Asia, Africa and the U.S.

Technology will enable Prudential to bring in more clients by shortening the time to issue policies to minutes from days and expanding an online chat service to deal with queries, Nicandrou said.

Instant Responses

“When everyone is used to almost instant responses, we have to make our offerings live up to that standard,” he said in Hong Kong. Automation is key “if you’re going to open your organization to doing business online with consumers.”

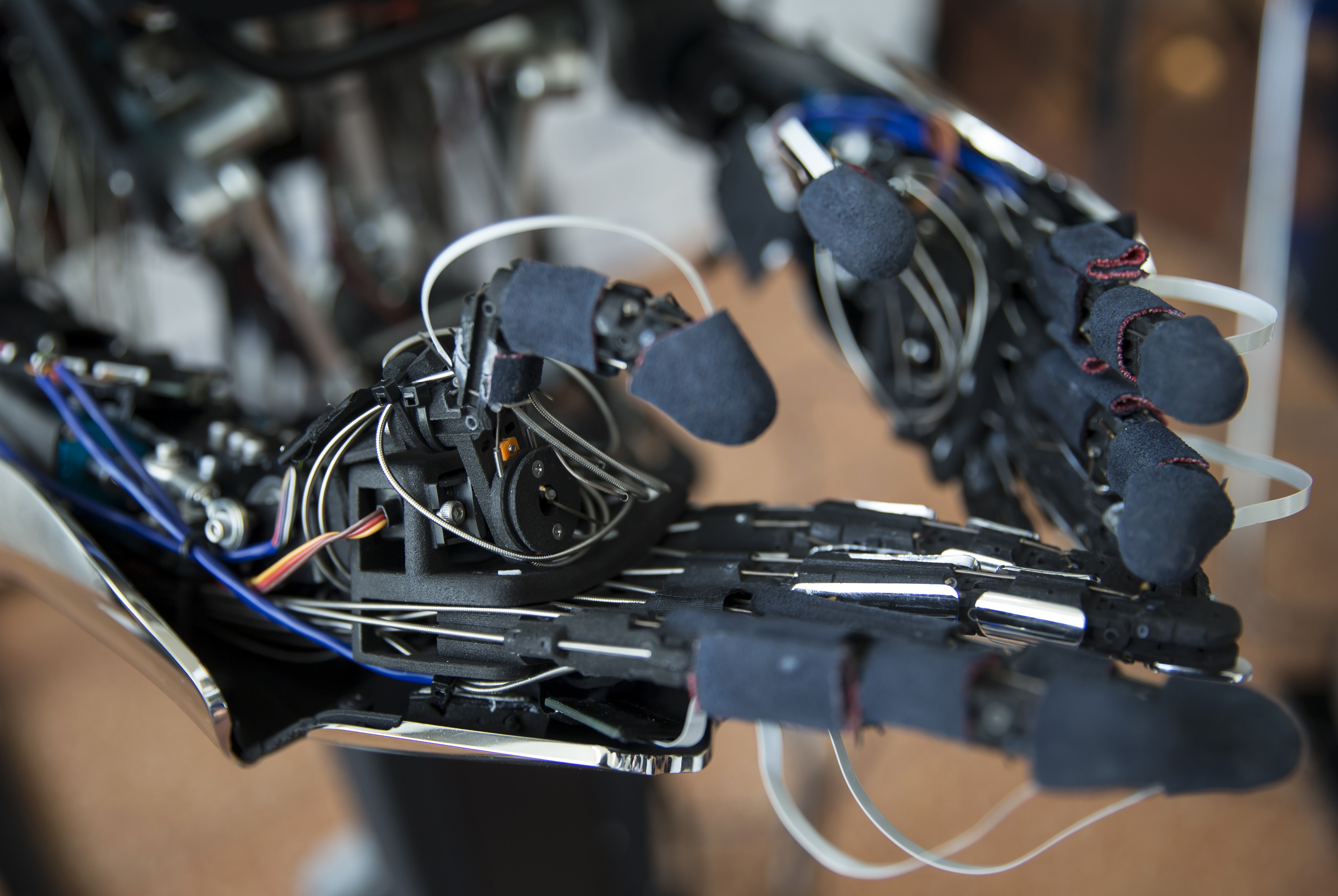

The insurer will roll out an artificial intelligence initiative that will allow the firm to settle hospital claims on the same day, Nicandrou said. The computer system, which Prudential plans to start first in Singapore this year, will look for certain words and treatments in photographed invoices, then examine prices and compare the information against its database and similar claims.

The process may take minutes and deliver about 99 percent accuracy, allowing the insurer to credit the person’s account on the same day. Hospital claims assessed by humans can currently take as many as eight days, Nicandrou said.

“We have a lot of data already in our system across the treatments,” he said. “You’re teaching your machine to assess whether the amount that is being charged is sensible for that treatment.”

Read how JPMorgan is hiring technology and math graduates in Asia

The London-based insurer has 1,500 technology staff in Asia, including data scientists, robotics engineers and automation specialists — a number that Nicandrou sees increasing over time.

“Really it’s a rallying call to make sure that the business modernizes and that we make the appropriate investment,” he said.

source:-bloomberg